Figures published towards the end of 2016, which showed that one in four non-food purchases were made online in November, underlines how commercially important it will be this year for brands and suppliers to gain a better understanding of shopper motivations and behaviours.

That’s the advice from category management and shopper marketing specialist Bridgethorne following research from the British Retail Consortium and KPMG. The research revealed that, in part due to significant online shopping activity across Black Friday and Cyber Monday, there was a 10.9% increase in online sales of non-food products in November compared to the same month last year. This is the third consecutive year that there’s been a year-on-year growth in online sales.

“To enjoy online success retailers and suppliers will need to work more closely together this year to understand the factors that influence the shopper online,” explains John Nevens, director, Bridgethorne. “These will not be the same as the shopper in store, where other factors come into play and other devices can be deployed to attract the shopper in one way or another.”

The Centre for Retail Research has said that total online retail sales in the UK in 2016 was likely to top £60 billion, a 14.9% increase on 2015.

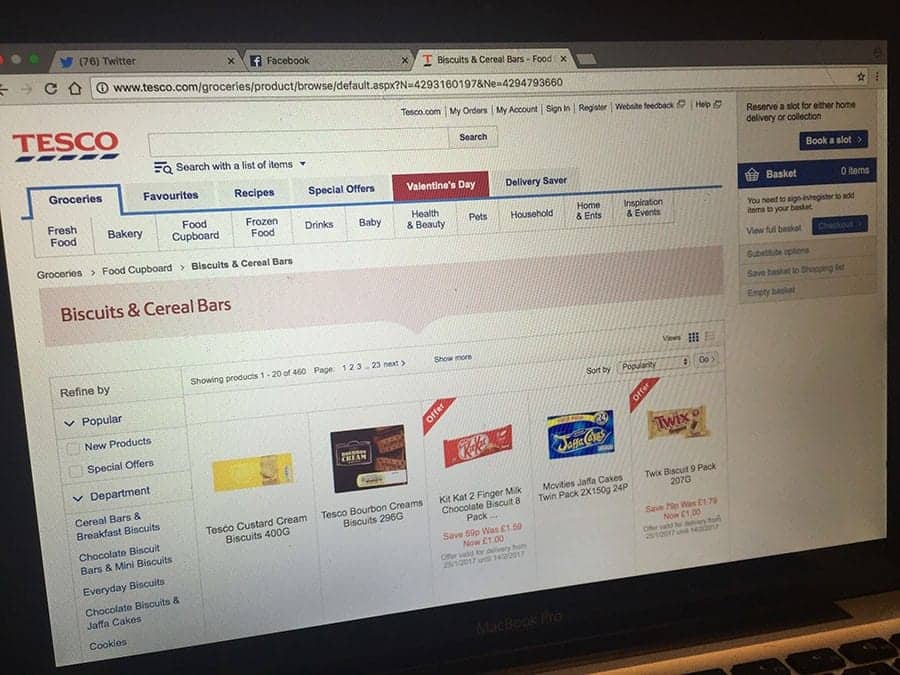

With online, Nevens says, sensory options like lighting, sound and smells are not available. Instead greater emphasis needs to be placed on visual encouragement and language prompts that tempt the online shopper, including product positioning on screen and the language used to describe them.

It was revealed last year that the average British adult now spends more time online than doing anything else in their life. Ofcom research showed that, on average, we spend a little more than one day each week online, with 10 per cent saying that they access the Internet more than 50 times each day. In a retail context, this makes effective online product display an essential skill for suppliers and retailers to get to grips with.

Significantly, the growth in online retailing merely increases the importance for both suppliers and retailers to think in terms of the ‘shopper’ rather than the ‘consumer’ because, as Nevens puts it, 100% of shopping is done by shoppers; it is not necessarily done by consumers.

“The shopper’s needs are always different to the consumer’s needs and suppliers need to understand that,” continues Nevens.

“Understanding what drives the shopper, the missions they take when they buy and the factors that influence their purchasing decisions will be central to long term commercial effectiveness across every platform.”

With online predicted to experience growth in excess of 65% over the next five years, Bridgethorne has added a series of e-commerce services to its portfolio, including understanding the e-commerce halo effect that sees around 60% of in-store purchases being influenced by digital. These services range from ecommerce capability assessments, digital shelf audits and ecommerce shopper activation to understanding the management of multi-channel and pureplay retailers, the e-commerce shopper journey and building effective commercial plans.

These form part of Bridgethorne’s comprehensive series of approaches that help supplier organisations address key aspects of Integrated Shopper Management as it pertains to their particular circumstances. Areas that can be addressed range from shopper understanding, through strategy and planning right up to activation and evaluation.

Ends.